It is no secret that Americans are aging, but what is too often lost is that most people will need help as they grow older.

Unfortunately, America does not have a strategy to deal with this growing demand. For some, this help comes in the form of needing just a little bit of assistance in the home with such tasks as cooking meals or getting groceries. For others, it is more comprehensive daily help in an assisted living community or nursing home care.

As chair of the newly created federal Commission on Long-Term Care, I believe it is imperative for Americans to understand that 70 percent of us who live beyond the age of 65 will need some form of long-term care, on average for three years.

This is a particularly significant statistic given the reality that our nation’s system of care is outdated and lacks the tools to meet the needs of our growing senior population.

To better understand Americans’ attitudes and perceptions around aging and long-term care, as well as levels of preparedness for future care, the Associated Press’s NORC Center for Public Affairs Research conducted a national poll of adults aged 40 and older with funding from The SCAN Foundation, which I head.

The implications of these findings are profound considering the population of adults over 65 will double to nearly 72 million people — 19 percent of the U.S. population — by 2030.

Counting on Family Members

For starters, most Americans today are operating under the assumption that they can count on family members to help care for them in a time of need.

About two-thirds believe they can look to their families for significant support and even more people think they will get at least some support from their families in a time of need.

However, in spite of these assumptions, nearly six in 10 are not even having conversations with family about their future desires and preferences for care.

This is not about having the death conversation — what you want to happen to you when you die. This is about having the life conversation — defining how you want to live in light of changing health needs and daily physical struggles that may emerge as you age.

Perhaps, even more remarkably, 30 percent of Americans would rather not even think about getting older at all. This denial about aging and future care needs can be of serious detriment to individuals who are suddenly thrust into a situation in which they need care and do not know where to turn for help.

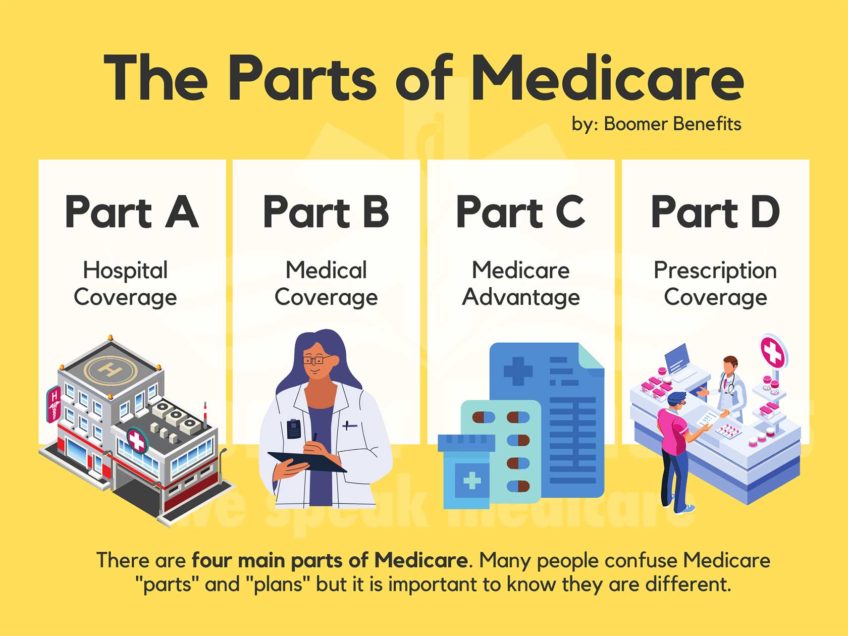

Misunderstanding Medicare

Americans also have major misconceptions about the costs of long-term care and about who — or what — will pay for these needs when the time comes.

While more than half (57 percent) of Americans 40 or older report having some experience with long-term care, most are not aware of how expensive it is. Almost half (44 percent) mistakenly believe that Medicare pays for ongoing care at home by a licensed home health care aide. And more than one in three Americans (37 percent) incorrectly believe it pays for ongoing care in a nursing home.

A mere 27 percent of older adults surveyed are confident that they will have the resources to pay for the care they need as they age. This confusion about how services are paid for leads to a lack of knowledge on how to plan and, again, individuals find themselves in situations of need with no idea of where to turn for help.

African Americans and Latinos were especially worried. Well over half of blacks (57 percent) expressed concern about being able to pay for needed care, compared to 45 percent of Hispanics and 41 percent of whites.

Also, half or more of African Americans and Latinos said they worry about becoming a burden on their families, in contrast to just over one in three whites. And almost half of blacks surveyed were concerned that they may leave debts to family related to long-term care, compared to just over one in four Hispanics and whites.

The prospect of ending up in a nursing home proved somewhat more troubling for African Americans (57 percent) than for Hispanics (44 percent) and whites (40 percent).

Promising Solutions

However, there is promise for innovative approaches to solving these issues: Americans across the political spectrum show majority support for public policy solutions to transform the nation’s system of long-term care. More than three-quarters of Americans support tax breaks to encourage saving for long-term care expenses; just over half support a government-administered long-term care insurance program similar to Medicare.

Solutions on how to effectively plan for future care are not partisan concerns but universal ones, with affordable and accessible services for older adults a priority for all.

The new poll reflects a serious gap in knowledge and awareness that leaves individuals and their families struggling to fend for themselves when it comes to paying for these services.

However, what this poll also shows is that people support a better model, a toolbox that offers a suite of services with viable options for individuals to stay in their homes and communities whenever possible.

The timing for this poll is critical as our window for action is short. Americans are clearly asking for solutions and mechanisms to begin to prepare for their future care needs so that we all can age with dignity, choice and independence.

Bruce Chernof, M.D., FACP, is the president and CEO of The SCAN Foundation, as well as the chair of the Commission on Long-Term Care.