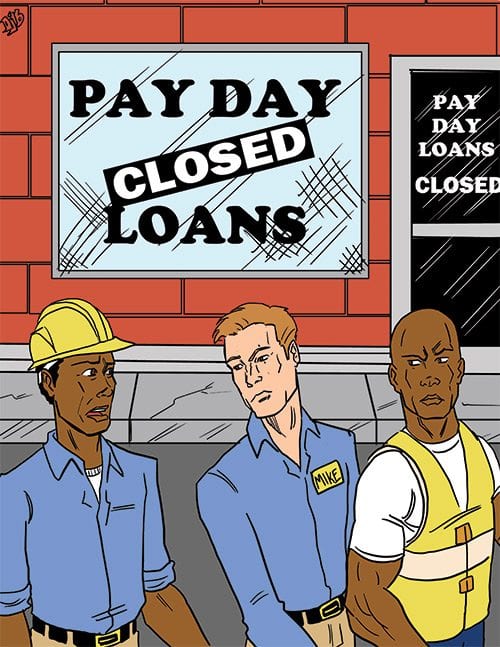

Payday loans have been disastrous for many low-income households. The default rate is about 20 percent and many borrowers are forced to renew with additional fees. Borrowers could end up with a debt that includes more fees and interest than the original amount of the loan. Now the Consumer Financial Protection Bureau proposes restrictions to require that lenders establish the borrower’s capacity to repay the loan.

Corporations and financially sophisticated individuals often borrow money. Debt is a significant aspect of American capitalism. However, there are rules governing the process. One basic principle is that the interest rate ought to be less than the projected percentage of profit from the investment of the loan. Different types of loans will have customary interest rates, such as “the prime rate” that banks charge their most credit-worthy customers. The Wall Street Journal prime rate is now about 3.5 percent, a far cry from the rate charged on payday loans.

It was once considered to be imprudent for an individual to create credit card debt to finance consumer purchases, but that principle is now considered to be archaic. In 2015 U.S. consumers amassed a credit card debt of $731 billion, with the average household owing $15,762. The largest personal loan category is for mortgages, $8.25 trillion or $168,614 per household, but real estate is an asset with the potential of increasing in value. Regulators are concerned about the payday loan industry, which has grown to about $46 billion primarily to pay for ordinary living expenses.

The credit card industry developed to assume liability for consumers who wanted to pay by check for goods or services. The retailer had no way of knowing whether a customer really had sufficient funds in the bank so that the check would be honored when deposited. At the end of the month the customer would receive an invoice from the credit card company for his purchase. It was not necessary to pay the debt all at once. Monthly payments could be made at a substantial rate of interest.

Credit card companies issue their cards to credit-worthy applicants. The payday loan industry has developed to serve those whose credit might not meet the standards of a credit card company. Consequently, the lender requires collateral. So the borrower must arrange for the lender to appropriate his next paycheck if he is unable to pay the outstanding balance of the loan. The term of the loan is only until the next paycheck, usually two weeks.

What usually happens is that the borrower is unable to repay the loan when due so he or she must roll it over, at a substantial fee. A small loan could balloon in size with fees. Annual interest would be in the hundreds. The amount of the loans is small and the fees incurred are often not inappropriate for the administrative time spent, but when calculated on an annual interest basis the rate can soar.

Regulations imposed by the Consumer Financial Protection Bureau will only mollify the issue. The real problem is systemic poverty. About 46 million Americans live below the federal poverty levels and about 88 million have no banking relationship. They are therefore required to pay substantial fees for any financial services that they require.

The American banking system does not adequately service those with limited income. Therefore, the Community Development Financial Institutions, a division of the U.S. Treasury, ought to develop a more effective solution.