Sheer Liability from the sharing economy

Take the correct steps with a lawyer or CPA before starting any kind of small business

Karen Crash, Wanda Wannabe and Ima Mess recently graduated from college and were excited to begin working on their tech startup, which they called Corcillum. Their problem, however, was money: to survive, pay off their student loans and fund the initial phase of Corcillum. But, because they were really smart, they had a grand scheme based upon the sharing economy. They would rent a big house for their own housing and office needs, and each of them would run a small cash business out of their house. Once they had accumulated enough money from the small businesses, they would launch Corcillum.

They found a large five-bedroom house, with a huge kitchen, just outside of Boston. The rent was $6,000 per month. Karen, Wanda and Ima slept in one of the bedrooms, and they found other young people who needed a short-term, inexpensive room to fill the other four bedrooms. Some of the people needed a room for a few days, and others needed it for a week or so. They didn’t want tenants because their lease prohibited it. They charged $100 per person, per night. Karen ran this business under the name of “Crash With Us.” She advertised via Facebook and posted signs at Boston-area colleges. After all costs (rent, electricity and laundry), the business was netting more than $2,000 per month.

Wanda was a “foodie” and had lots of friends at a local cooking school. She offered to run a business from their large kitchen, called “Chef Wannabe’s Kitchen.” Wanda let 12 of her friends take turns using the large kitchen to make meals for sale. Customers could “eat in” or “take out.” Wanda and the chefs promoted the business through Facebook, and Wanda posted signs and notices wherever she could. This also provided food for Karen, Wanda and Ima, and the people who slept at the house could buy meals, too. The business took off. The chefs paid Wanda 15 percent of their gross proceeds, and the business was making a net profit of more than $1,800 per month.

Ima’s business was a housecleaning service called “Ima Mess Housecleaners,” to help her friends who recently graduated and didn’t have the time to clean their apartments. The workers were college students who needed some money but couldn’t find jobs. Ima hired them as independent contractors and provided them with cleaning supplies. The workers provided their own transportation to get them to the jobs. Ima charged her customers $25.00 per hour, per person; for 2 people working 90 minutes, Ima got paid $75. She paid one-third to the workers and kept the rest. The business was netting over $1,500 per month.

Together, Karen, Wanda and Ima were bringing in nearly $6,000 per month, above all of their housing, utilities and other costs. They began working on Corcillum, with a nifty income stream from the three small businesses.

In the seventh month of the lease, Karen, Wanda and Ima received a letter from their landlord telling them that he was selling the house and introducing them to their new landlord. A couple months later, the new landlord showed up unexpectedly. He found people living in the house who were not on the lease, and people using the kitchen for commercial purposes. When Karen explained what they were doing, he was livid and promptly sent them an eviction notice.

At about the same time, one of Wanda’s chefs apparently left some sushi-grade tuna unrefrigerated for too long, and nine customers became very sick, with one hospitalized. The label said the food was prepared at Chef Wannabe’s Kitchen, with Wanda’s address. Wanda received a letter from a lawyer representing the hospitalized customer. She also received Cease and Desist Letters from the town’s departments of Public Health and Inspectional Services.

Shortly after that, two of Ima’s cleaning workers were injured. One fell down at a customer’s house and broke an ankle. The other went through a red traffic light on the way to a job, and had an accident, badly injuring himself and the other driver. Ima received demand letters from insurance companies and lawyers. She also received a letter from the state’s Department of Industrial Accidents, asking about Worker’s Compensation for the injured workers. Of course, Ima had none, since these were independent contractors.

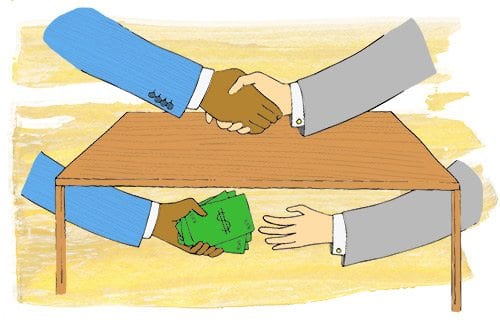

Karen, Wanda and Ima were overwhelmed. Not knowing what to do about these setbacks, they made an appointment with their friend, Laurie Lawyer. Laurie’s news was not good. She told them that each of these businesses required permits or licenses, which they did not have, so they were subject to substantial fines and penalties. They should have had LLCs or corporations to protect them from personal liability. They also needed liability insurance and contracts with all of the people who were working with and for them. Without these, they now could be sued personally.

Laurie explained that even though these were cash businesses, they were required to pay taxes on the money they made. In addition, under their lease and under the zoning laws, they were not permitted to operate these businesses from their home, and they would be evicted.

Lastly, they learned from Laurie that Ima’s workers were not independent contractors under the law. Since they were not being paid minimum wage or overtime, the three of them could be sued personally for unpaid wages, which had a 3x penalty under state law. The failure to have liability insurance made them liable for the other driver’s medical expenses, and the failure to carry worker’s compensation insurance not only made them liable for the medical expenses of the injured workers, but subjected them to additional civil — and possible criminal — penalties. Moreover, they remained obligated for unpaid employer taxes on employee income.

Suddenly, Corcillum was “on hold” indefinitely, and all of the money accumulated by Karen, Wanda and Ima was going to legal fees, penalties and unpaid taxes. They learned the hard way about another side of the sharing economy. Nothing replaces smart business planning. There are tons of opportunities from transportation, housing and other services that make up the sharing economy, but these opportunities have potential pitfalls that can be devastating to owners and workers.

If you want to start and run a business based on the sharing economy, then in the words of Benjamin Franklin, “an ounce of prevention” from your lawyer or certified public accountant will be worth more than “a pound of cure.”

Jan Glassman is the founder of Daily General Counsel™, www.DailyGeneralCounsel.com, a Boston-based startup that provides very affordable legal services to small businesses and startups that otherwise could not afford a highly experienced business lawyer and would “go it alone.” DailyGC™ lawyers spend a full business day at their clients’ places of business, working directly with owners to resolve their most pressing sales, operations, employment and other legal/business problems. Prior to founding DailyGC™, Glassman was general counsel for a national management consulting firm that served small businesses throughout the United States. Follow Jan Glassman on Twitter @DailyGC