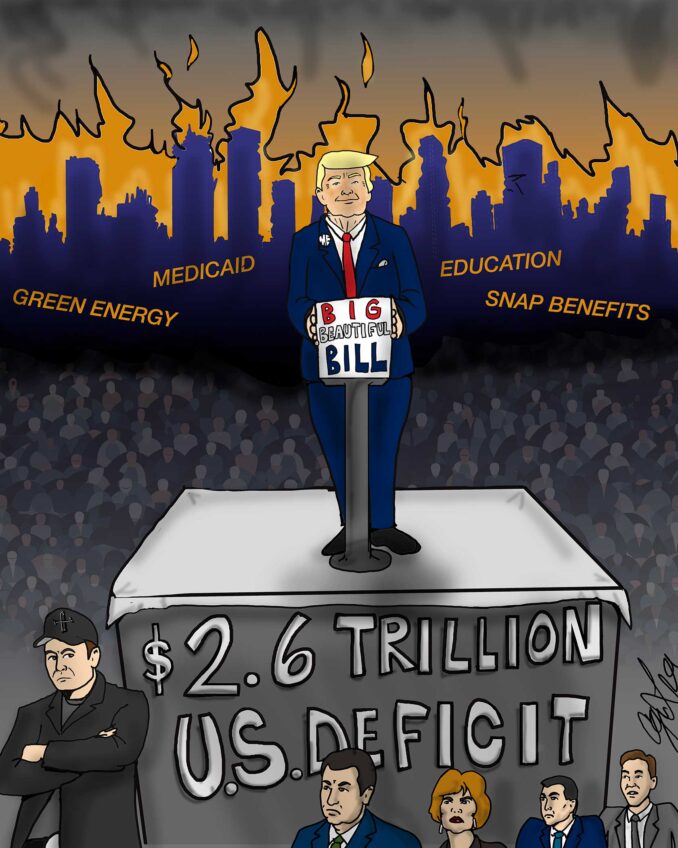

For most people who either work or receive retirement or other fixed benefits, it seems that money always goes a lot quicker than it comes. While some economists marvel at Wall Street’s brisk trading and declare that the economy is better than ever, not everyone has been included. On Main Street America, millions of people know that the cost of living is rising faster and higher than their incomes.

When triple-digit predatory lending is added to already financially challenged consumers, paydays become ‘exchange days,’ swapping those hard-earned monies for the bills waiting to be paid. Too many times the terms of credit, including high-cost interest and fees, wind up costing far more than the monies originally borrowed. Even worse, every loan payment deepens the debt, and drives consumers further from financial freedom.

So why did two federal financial regulators take recent actions that promote predatory lending?

On Nov. 18, the Office of the Comptroller of the Currency (OCC) proposed allowing banks to serve as a pass-through to predatory lenders. This change will facilitate schemes that consumer advocates term “rent-a-bank.” Participating chartered banks use its name and privileges on loans. A key privilege of the scheme is that unlike payday lenders, banks are exempt from state rate cap laws. The bank charter enables the payday lender to charge interest rates without regard to what safeguards were enacted by the states.

The Federal Deposit Insurance Corporation (FDIC) followed OCC’s lead the following day, Nov. 19, with its own version of facilitating rent-a-bank schemes, and received approval at its same-day board meeting.

Allowing online predatory lenders to evade state interest rate caps will put people in debt and go against what the public wants. For example, California recently signed into law a rate cap of approximately 36% on loans of $2,500 to $10,000. Supporting rent-a-bank schemes would undercut this new law and could allow for abusive loans that could annual percentage rates, or APRs, well above 100%.

Beyond essentially rolling back interest rate caps in 16 states and the District of Columbia, the regulatory reach of these two agencies is significant.

OCC supervises an estimated 1,400 national banks, federal savings associations and federal branches and agencies of foreign banks that operate in the United States. Approximately 4,000 banks chartered by the states or by the federal government fall under FDIC’s supervision. It is also the back-up supervisor for uninsured banks and thrifts. Each regulator is governed by a five-member Board of Directors, appointed by the President and confirmed by the Senate.

And now, both agency actions appear to run counter to their stated missions.

According to OCC’s website, the agency “ensures that national banks and federal savings associations operate in a safe and sound manner, provide fair access to financial services, treat customers fairly, and apply with applicable laws and regulations.”

Similarly, FDIC “preserves and promotes public confidence in the U.S. financial system by insuring deposits in banks and thrift institutions for at least $250,000; by identifying, monitoring and addressing risks to the deposit insurance funds; and by limiting the effect on the economy and the financial system when a bank or thrift institution fails.”

For consumer advocates, there is nothing safe or sound about predatory lending.

“Rather than facilitating high-cost loans, OCC and FDIC should be doing more to ensure banks better serve our people and communities,” said Diane Standaert, director of the Hope Policy Institute, that along with its parent organization, Hope Enterprise Corporation, serves Southern consumers residing in Alabama, Arkansas, Louisiana, Mississippi and Tennessee.

“It is even more troubling that the OCC and FDIC proposals come as the Consumer Financial Protection Bureau is separately considering a proposal to repeal protections for payday loans, car title loans, and other high-cost loans,” added Standaert.

“In 2010 in the Dodd-Frank Act, Congress limited the bank regulators’ authority to preempt state consumer protection laws,” noted Lauren Saunders, associate director of the National Consumer Law Center, “yet the OCC and FDIC are ignoring those limits.”

Rebecca Borné, senior policy counsel at the Center for Responsible Lending, concluded, “Voters of both parties overwhelmingly support limiting interest rates to 36% or lower, and we encourage all to speak up loudly against the proposal to let banks help predatory lenders charge rates that voters have said should be illegal.”

Charlene Crowell is the Center for Responsible Lending’s communications deputy director.