Relief is on the way for Mass. renters, owners

Legislature passes anti-eviction, foreclosure law

Homeowners and renters may be increasingly feeling a pinch, with the COVID-19 pandemic expected to peak in Massachusetts in the next week, an economy that is grinding to a halt and, for many, a loss of income that spells trouble for renters and landlords alike come May 1. But some relief is underway.

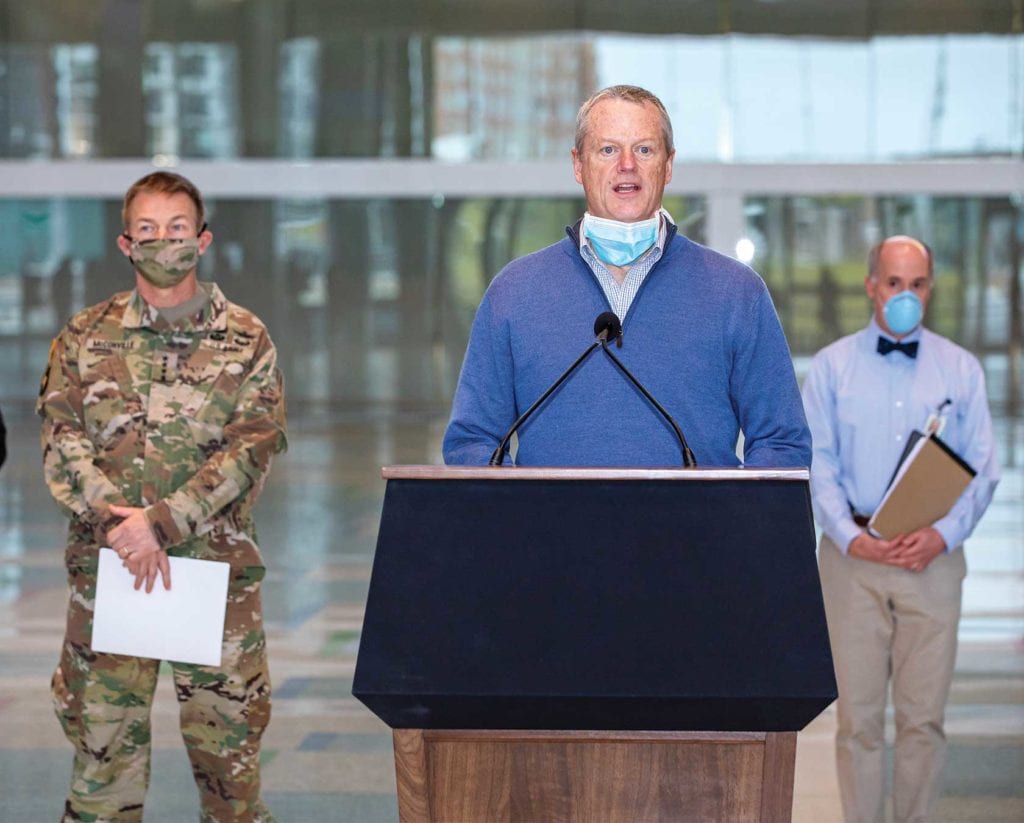

The Massachusetts Legislature last week passed a bill that would ban foreclosures and evictions and require that banks grant up to six months of mortgage forbearance to homeowners who are affected by the COVID-19 pandemic. The legislation, which Gov. Charlie Baker signed into law Monday, would extend to owner-occupants of homes with up to four units.

“This gives immediate relief not only to the more than 700 families who received eviction notices after March 16, but also people who received eviction notices before,” said Lisa Owens, executive director of the tenant rights group City Life/Vida Urbana. “This is also a good bill for homeowners and small business owners.”

Under the moratorium, landlords cannot evict tenants for 120 days or until 45 days after stay-at-home order is lifted in Massachusetts. Owens says in the last three weeks, City Life/Vida Urbana’s eviction hotline has received 450 calls.

“These are well-known corporate landlords who are still sending eviction notices,” she said. “The vast majority of the calls are, ‘Help, I can’t pay my rent and I’m going to get evicted.’ And that’s often tied with, ‘I don’t have money to buy food.’”

For owner-occupants in Boston, Mayor Martin Walsh has sought help. Two weeks ago, Walsh brokered an agreement with 13 of the largest lenders in Boston, persuading them to offer a minimum of three months of mortgage deferral and waive credit reporting, late fees and interest on the deferred portion of the loan. Under the terms that Walsh negotiated, the deferred payments are tacked on to the end of the mortgage.

“No person should have to worry about losing their home right now,” Walsh said in a statement sent to news media. “During these times of global uncertainty, homeowners and renters in Boston can be certain that we are doing everything we can to help ease the burden brought on by this pandemic and give them much-needed flexibility.”

The protections at the state and local level mean that, so far, the pandemic and the economic slowdown that it has precipitated will not likely lead to the displacement and dispossession seen in the great recession that followed the housing market collapse in 2008. While banks received a hefty bailout during that recession, in this go-around, borrowers and tenants are so far receiving a measure of protection.

Maureen Flynn, deputy director of the City of Boston Home Center, said the city has so far not received many calls from homeowners, but added that the agency might still see an uptick in delinquencies if borrowers pass the three-or six-month limits set by banks and are still unable to pay.

“We have asked banks that if they get to a place where they can’t work with a customer that they refer them to us before they begin a foreclosure,” she said.

Tom Callahan, president of the Massachusetts Affordable Housing Alliance, said his Dorchester-based organization, which runs a first-time homebuyer program, has so far received a trickle of calls from people who had trouble paying their mortgages.

“We haven’t been inundated,” he said. “Hopefully we won’t be. But we’re preparing for it.”

While foreclosures are costly for banks, costing an average of $20,000, banks have in the past preferred the finality of foreclosure proceedings to the uncertainty of working with property owners who are in arrears.

Callahan cautioned that the three- and six-month deferrals promised by the banks and the state Legislature might not be enough, noting the economy won’t likely suddenly restart when stay-at-home orders are lifted.

“Some industries won’t bounce back immediately,” he said. “The lingering effects could last quite a while.”

But while the 2008 mortgage crisis disproportionately affected black and Latino borrowers, the current crisis may cut a broader swath through America, raising the possibility for broader political support for relief, Callahan added.

“The response so far has been more immediate,” he said.

Owens, too, said she’s concerned about what comes after the moratorium on evictions is lifted, given that corporate landlords will likely demand back rent from tenants after the 45-day period is up.

“On day 46, we could see a bunch of eviction orders,” she said. “That would be unacceptable.”

Owens said City Life and other housing groups are communicating with activists in other states to determine what may work in Massachusetts.

“We’re looking at the best legislative vehicles to address this problem,” she said.

Local tax and fee relief

In other news, Walsh announced that the city has extended the due date for property tax bills from May 1 to June 1. The city is also waiving interest on late property tax and motor vehicle excise tax payments that were originally due after March 10. Residents will have a grace period, with no late fees, until June 30. The due date for residential and personal tax exemptions has been extended from April 1 to June 1.