In a year fraught with financial challenges, going home for the holidays will have heightened significance this year for many Black and Latino families.

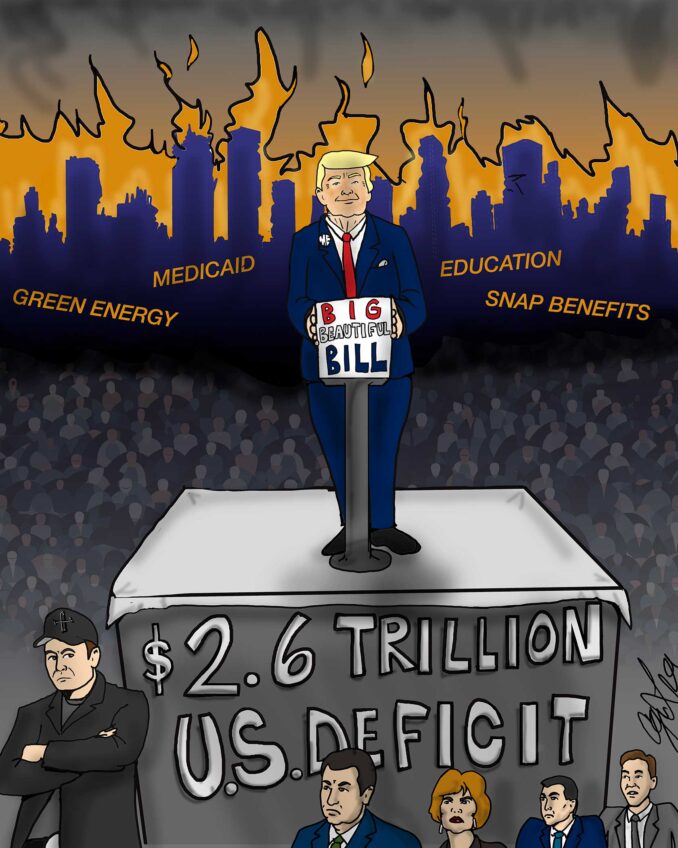

New research findings reveal that between 2019 and 2021, a period that included COVID-19 pandemic assistance programs, homeownership among Black and Latino families increased. The increase was due in part to pandemic assistance, like suspended student loan payments and extended or enhanced unemployment benefits that changed household budgets. During these same years, financially troubled homeowners who received federal assistance gained the resources to avoid foreclosure, largely through forbearance programs.

As a result, Black and Latino homeowners shared in the largest equity appreciation in the past three decades. As home equity grows, so does family wealth.

Analyzing the latest data from the Census Bureau’s American Community Survey, the Urban Institute, a D.C.-based nonpartisan research organization, found that Black household homeownership rose 2 percentage points, to 44 percent from 2019-2020., Latino household homeownership rose 2.5 percentage points, to 50.6 percent. Both increases surpassed the 1.2-percentage-point homeownership rate increase for white households during the same period.

“The Black homeownership rate has experienced a continuous decline since the Great Recession, and Black households have been disproportionately affected by predatory lending practices, but the Black homeownership rate is finally showing gains,” states the Institute’s findings.

The largest increases in the number of Black homeowners occurred in Florida, Georgia and Texas.

“Despite the pandemic’s negative effects on employment, swift government actions, such as forbearance and unemployment benefits, helped Black and Latino households sustain homeownership and helped many enter homeownership and benefit from historically low interest rates,” the Institute authors continued.

Andre Perry, a senior fellow at the Brookings Institution, recently told the Washington Post, “We’re seeing a real spark in Black and Latino homeownership because people — in large part, millennials — were able to save during the pandemic. Now, whether it’s sustained, that’s a different story. But what you saw in 2021 is a good thing, because homeownership creates wealth and other opportunities that benefit entire communities.”

Related findings by the Joint Center for Housing Studies (JCHS) at Harvard University underscore how this small but important rise in homeownership benefitted families of color.

In its annual State of the Nation’s Housing 2022, JCHS reports that despite the economic downturn brought on by the pandemic and the surge in home prices, 2.2 million new homeowners were added between the first quarter of 2020 and the first quarter of 2022, boosting the nation’s total number of homeowner households to 83.4 million.

Despite national growth in homeownership between 2020 and 2022, the Harvard report makes it clear that lingering racial disparities in homeownership limit Blacks and Latinos from achieving large equity gains.

“In 2019, the median net wealth of Black homeowners ($113,100) was just over a third of that of white homeowners ($299,900) and the median net wealth of Hispanic homeowners ($164,800) was still roughly half of white homeowners,” states the report. “At least in part, these disparities reflect consistently lower home valuations in neighborhoods that are predominantly Black or Hispanic.”

Homeownership access is also related to an important market variable: low mortgage interest rates. Over half of outstanding mortgages in the fourth quarter of 2021 had interest rates below 4.0 percent, including 13% with rates below 3.0 percent. Lower interest rates translated into consumers qualifying for larger and/or higher-priced homes. Conversely, as these rates have increased in recent months, housing dollars cannot go as far.

Hence it is reasonable to conclude that the array of federal assistance during the pandemic enabled Black and Latino Americans to financially piece together a way forward for their families. From 2020’s Economic Security Act (CARES Act) that allowed borrowers to take forbearances for periods lasting up to 18 months, to extended and enhanced unemployment benefits, to student loan payment suspensions, and more — timely, targeted federal initiatives made measurable progress possible.

“The lessons learned during the pandemic have led to a number of proposals to greatly expand the housing safety net and provide increased support for first-generation homebuyers,” stated Chris Herbert, JCHS Managing Director. “While these measures have yet to be implemented, it is important to continue the policy debate over the best approaches to making housing affordable for all.”

Charlene Crowell is a senior fellow with the Center for Responsible Lending.