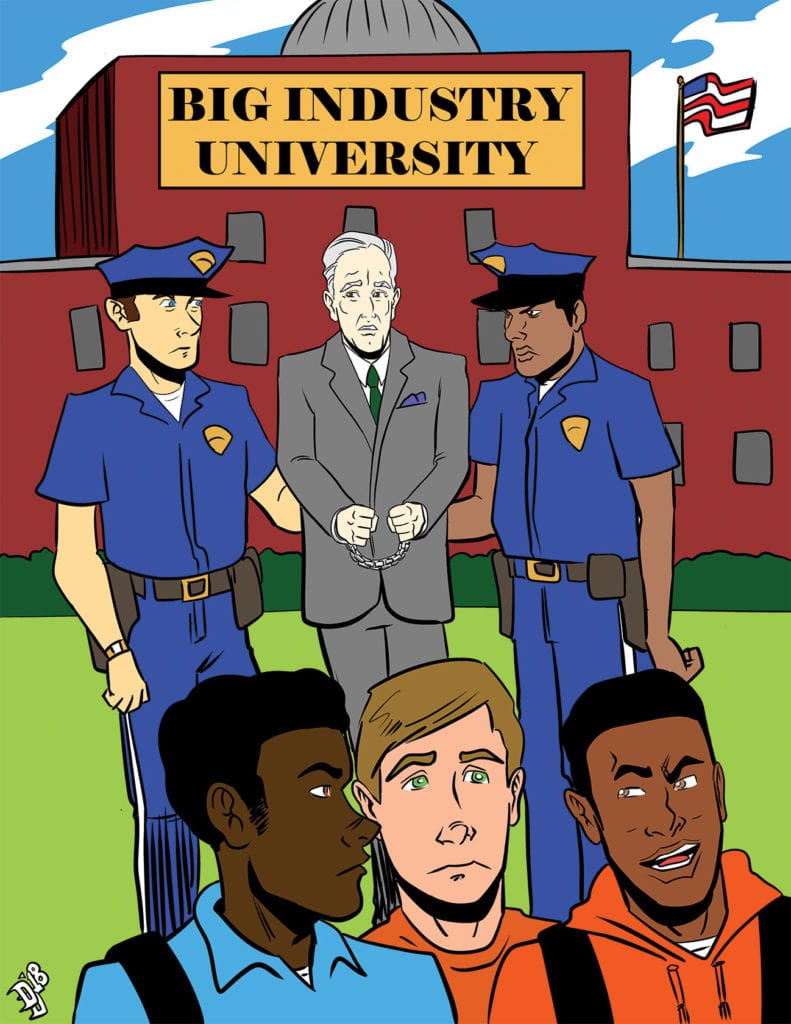

College classrooms across the country are filled with students eager to learn. An estimated one-third of students now rely on loans to pay for the cost of their education. There has been some debate as to whether the cost of higher education is worth it, but most of the jobs with a future require relatively well educated employees. Some for-profit schools have taken advantage of the higher employment requirements and have failed to provide the necessary job skills. The U.S. Department of Education Secretary Betsy DeVos has lost her effort to mitigate damages for fraudulent education mills.

The average college loan debt in the U.S. as of 2018 was $37,172 per student. With about 44 million borrowers that amounts to $1.5 trillion in outstanding debt. If students are unable to acquire the skills necessary to obtain a job and pay their debt, then they begin adult life saddled with an unfavorable credit rating.

The enormous size of the debt attracted numerous for-profit institutions that used dynamic marketing strategies to recruit working class applicants who envisioned themselves being hired away to the executive suite upon graduation. But when the quality of the education was deficient, or the job market for the advertised careers was overestimated, beguiled students were left with nothing more than a substantial debt.

President Obama established a procedure to protect students from predatory and fraudulent practices of such schools. According to reports, only 11 percent of college students attended for-profit schools, but they accounted for 43 percent of student loan defaults. These schools were heavily dependent upon federal loans for operating revenue.

When school practices were considered to be fraudulent, deceived students’ loans were forgiven and the schools were no longer permitted to rely on federal loans.

Secretary DeVos chose to amend these regulations and deprive students of the remedies available to them when they have been defrauded. The DeVos amendments would have the following affect:

Rules would make it more difficult for students even to establish that they are eligible for relief; students would be denied the protective intervention of states attorneys general; students would be required to default on their loans before objecting to terms and submitting a claim; each student must file an individual objection rather than filing a group complaint; and students would be forced to rely on mandatory arbitration rather than making a claim to be adjudicated, pursuant to a reasonable process.

Attorney General Maura Healey filed suit, with 18 other attorneys general that she had organized, to challenge DeVos’ action. Healey’s suit in the U.S. District Court in Washington, D.C. prevailed. She asserted in the case that what Secretary Devos proposed “is a license to cheat students and taxpayers.”

The court’s opinion called DeVos’ action “unlawful,” “arbitrary and capricious,” and “procedurally invalid.” Remedies will be established in later hearings. There was no sensitivity in the DeVos administration to the harm her policy would inflict on youthful students who had been victimized by predatory private school administrations.